Updated: Dec. 20, 2019

Electric cooperatives could save more than $30 million a year in pension insurance premiums thanks to a sweeping government funding bill passed Thursday by Congress.

The legislation also repeals the so-called “Cadillac tax” imposed by the Affordable Care Act on health care benefits that co-ops and other employers provide for their workers.

The Senate voted Thursday to pass the bill, which was approved Tuesday by the House. President Trump has signed it into law.

NRECA has been advocating reform of the pension issue for several years, and passage of the bipartisan SECURE Act was a top priority for 2019. Nearly 2,000 co-op leaders lobbied Congress on the issue earlier this year as part of NRECA’s Legislative Conference.

The bills that provide relief to co-ops on both the pension and health care issues were approved by lawmakers as part of a broader legislative package that funds the federal government through September 2020.

More Spending Bill News: Congress Passes RURAL Act

“I applaud Congress for recognizing important differences in our pension plans and passing this bill to save electric co-ops more than $30 million annually,” said NRECA CEO Jim Matheson. “Our pension plan helps co-ops attract and retain qualified employees for the future, while promoting economic security for retirees.”

Rep. Ron Kind, D-Wis., one of the lead sponsors of the SECURE Act, said the bill would “immediately and permanently” reduce pension premiums for co-ops starting this year.

The House passed the SECURE Act 417-3 in May, but it stalled in the Senate until a larger government-funding deal was reached.

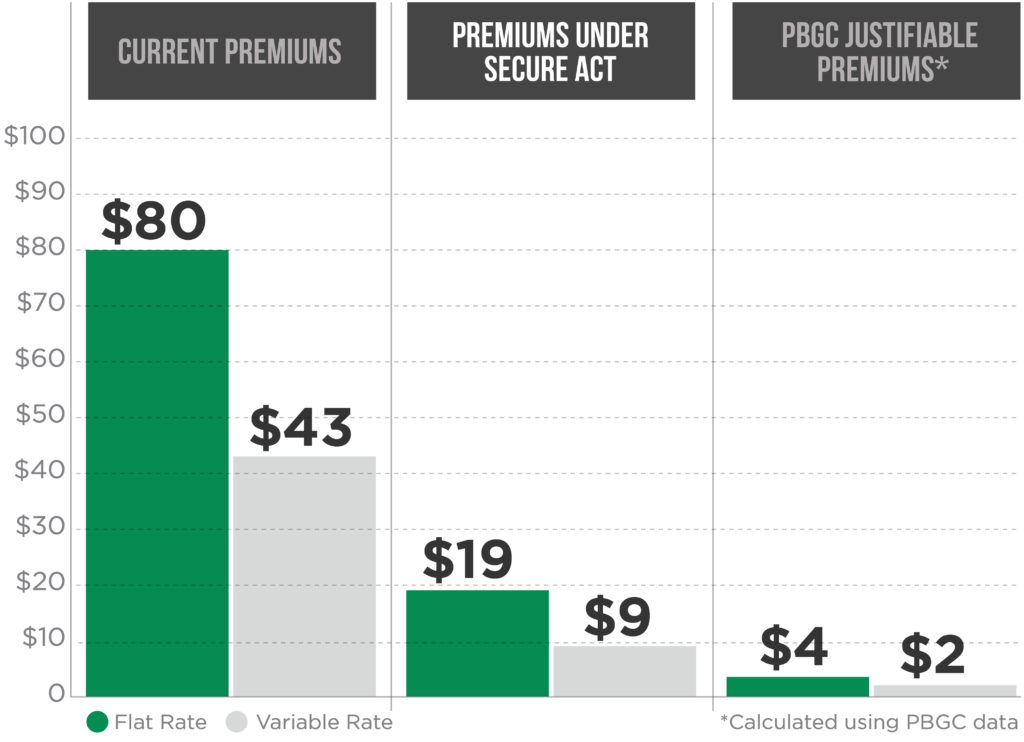

The SECURE Act adjusts the formula that determines what certain co-ops and other not-for-profit organizations must pay to the Pension Benefit Guaranty Corp. The decrease in premiums for co-ops that participate in the NRECA Retirement Security Plan reflects the extremely low risk that they will default on their pension payments.

The PBGC is an independent federal agency created by Congress in 1974 to guarantee that American workers would receive their retirement benefits even if their employers went bankrupt. It is funded by employers who pay premiums to insure their workers’ pensions.

However, co-ops and charity groups were forced, beginning in 2006, to subsidize large, for-profit Fortune 500 corporations that have pensions at much greater risk of going bankrupt, said NRECA lobbyist Christopher Stephen.

“This victory demonstrates the strength of our network and enables our members to focus resources on their core mission to provide affordable, reliable and sustainable services to their consumer-members,” Stephen said.

More than 880 co-ops participate in the NRECA retirement plan, which covers more than 56,000 employees in 47 states.

In addition to Kind, the SECURE Act’s lead sponsors were House Ways and Means Chairman Richard Neal, D-Mass., and Reps. Kevin Brady, R-Texas, and Mike Kelly, R-Pa. In the Senate, similar legislation was championed by Finance Committee Chairman Chuck Grassley, R-Iowa, and Ron Wyden of Oregon, the panel’s senior Democrat.

The separate “Cadillac tax” issue was created by the 2010 passage of the Affordable Care Act, better known as Obamacare. It was set to impose a 40% excise tax on employer-sponsored health care plans that are considered “high cost,” including those offered by co-ops through the NRECA group benefits program.

Congress previously signaled its dislike for the “Cadillac tax” by delaying it from taking effect four times. It was set to begin in 2022 if lawmakers hadn’t acted.

Co-ops provide health insurance benefits to more than 100,000 employees, retirees and their families.

NRECA has been a leader in supporting a full repeal of the tax. Taxing any part of co-op employees’ health care benefits would have resulted in less comprehensive health coverage for families at a higher cost to them, Stephen said.

“No cooperative, whether they get health insurance through NRECA’s benefit plans or from another source, should be penalized for doing the right thing for their employees just because our members live in rural communities where limited access can drive the cost disproportionately higher than in urban areas,” he said.

Erin Kelly is a staff writer at NRECA.