NRECA is moving into 2026 with a list of legislative and regulatory priorities aimed at making it easier for electric cooperatives throughout the nation to provide reliable, affordable power to their consumer-members.

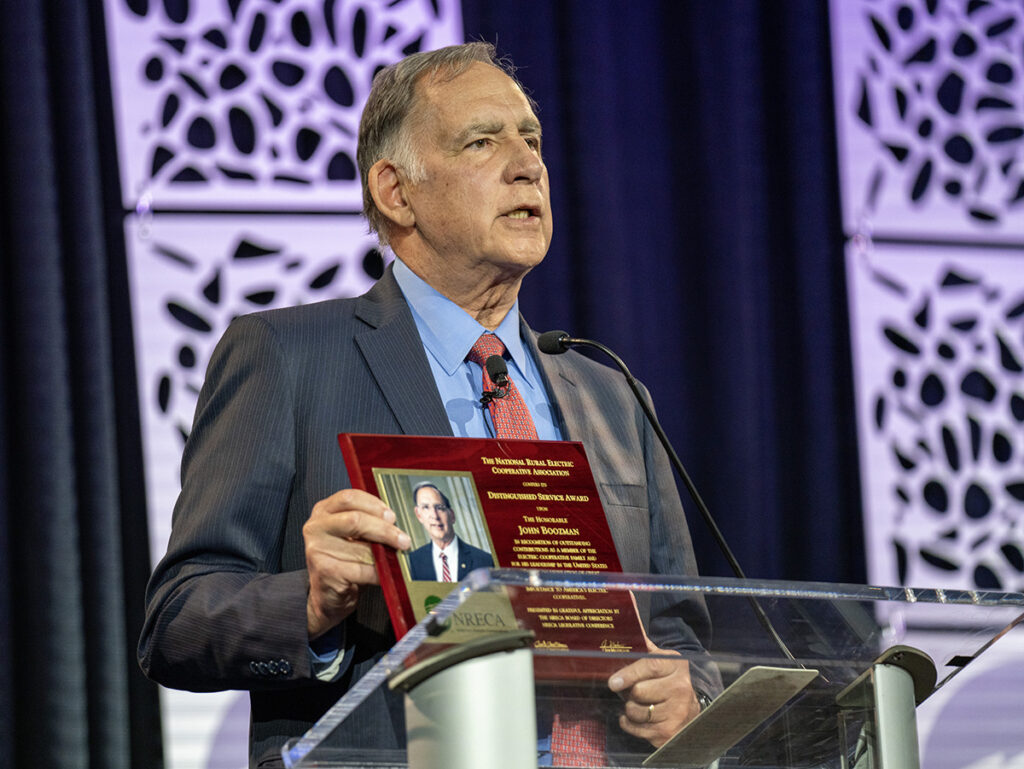

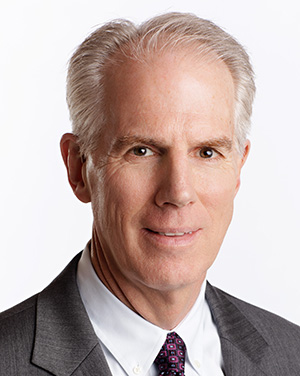

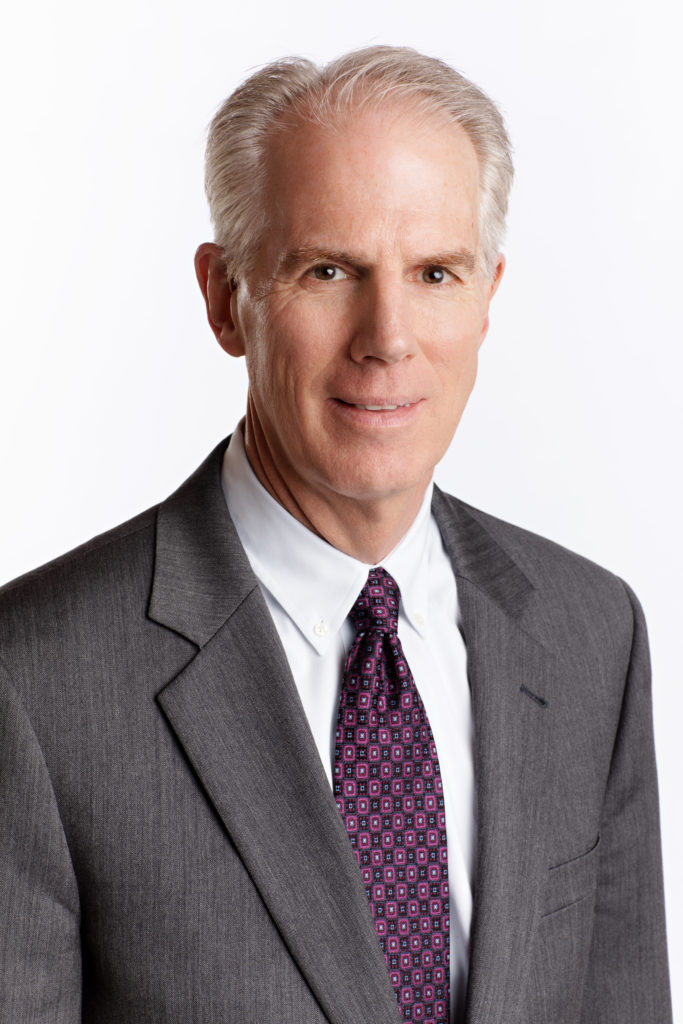

“We are listening and hearing from our members about what is most important to them and where policy changes can improve the business environment for co-ops and improve the lives of the people in the communities they serve,” said Louis Finkel, NRECA’s senior vice president of Government Relations.

Here’s what Finkel had to say about NRECA’s federal priorities for 2026.

What are NRECA’s top legislative priorities for this year and why?

Finkel: There are several places where Congress can make changes that would be incredibly impactful. We are focused on giving co-ops the tools they need to keep the lights on at a cost their members can afford, and there are three areas that I think about a lot.

First, we need more generation, not less, and we need to improve our resiliency. And to do that, we need to make the investments necessary to keep the lights on at a cost our members can afford, which means we need to be able to build more. And to do that, you need to expedite the permitting process.

We’re dealing with a federal permitting process that was developed more than 40 years ago. It has only been updated marginally over the course of the last 40 to 50 years. And we live at a very different time.

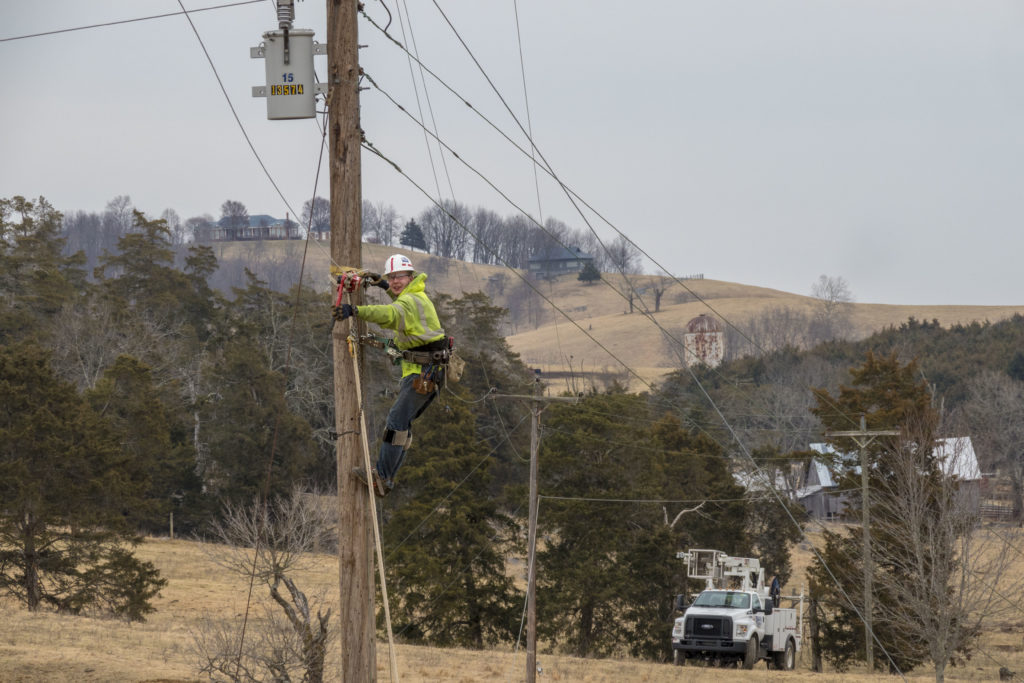

And to add more generation, you need more transmission. We also need the ability to improve our distribution and transmission systems.

We have aging infrastructure that needs to be replaced, and we need to add increased resiliency. And, so, we need to first and foremost reform our permitting process.

Secondly, for the last several years, we’ve talked about the need to reform the Federal Emergency Management Agency and ensure that cooperatives can receive the support they need from the federal government on their worst days. The FEMA process is cumbersome, it’s difficult, it’s inconsistent. We need a FEMA that works for our cooperatives and the communities they serve.

We need predictability and we need to know that when a disaster strikes—whether that is an ice storm or a hurricane or a wildfire or a flood—that we have a strong federal partner in FEMA that will be there to support our cooperatives and their communities.

The other thing we need to do, and this kind of fits into the issue of permitting reform, is improve our co-ops’ ability to mitigate against the threats of wildfires. We need quality vegetation management. The Fix Our Forests Act has been something we’ve been pushing for several years, and we need the ability to finally see that through.

And, lastly, our co-ops need the tools and partnerships to support both their system improvements and their routine maintenance. The Rural Utilities Service is an incredibly important partner for us.

And as supply chain costs rise, inflationary pressures rise, and the needs for more generation, more transmission and distribution continue to grow, we need to be able to borrow from RUS. That means supporting both continued appropriations from Congress and thinking about RUS growing the portfolio of loans that they can make on an annual basis.

We’ve seen improvements there. But each year for the last several years, RUS has hit their loan cap. They have the ability to increase it, but we need to make sure cooperatives demonstrate how they are effectively using the loans provided by RUS to support these annual increases.

You mentioned FEMA reform as a top priority. As you know, the House Transportation and Infrastructure Committee passed the bipartisan Fixing Emergency Management for Americans Act last year. What’s the next step on that?

Finkel: Our objective is to make sure that the FEMA bill hits the House floor as soon as possible and that we continue to build the momentum and support for it. Every time there’s a storm and the FEMA process doesn’t work, it’s a reminder that there’s a need to reform it. We’ll continue to carry that message over and over again.

There was some good news for NRECA on permitting reform late last year when the House passed the SPEED Act and the PERMIT Act to streamline the process. Do you think the Senate will act on those bills?

Finkel: I think there’s broad recognition that the process needs to be reformed. There is still a question of what exactly does that look like and what shape does it take and how long does it take to get done. The House has completed their work and there continue to be discussions in the Senate. We will continue to push for progress in those discussions.

Congress increased the RUS Electric Loan Program from $6.5 billion to $7 billion for this fiscal year. Do you think they’ll boost it again for 2027?

Finkel: We think there’s a continued opportunity to have conversations with policymakers about the value that the RUS Electric Loan Program brings to the communities we serve.

And as electric demand grows and as system maintenance and improvement continues to be important for resiliency, we believe that there’s a need to continue to have that conversation about growing the RUS lending authority. The fact is that the federal government makes $500 million a year in interest that co-ops pay on those loans, so there is a direct benefit to the government. Not to mention the co-op communities that benefit from the investments being made.

Shifting gears beyond Congress, what are NRECA’s top regulatory priorities at agencies for 2026?

Finkel: For several years, we have advocated for repealing unlawful, unrealistic and unreasonable regulations finalized by the Biden administration.

We continue to be optimistic that the Environmental Protection Agency will continue to walk back the power plant rule and the series of other regulations promulgated by the Biden administration that hamper always-available power. We need more generation, not less. And forcing the premature retirement of existing generation and making it impossible, if not cost-prohibitive, to build new generation should not be our energy policy.

We continue to work with the Department of Energy on implementation of really important infrastructure investments that make our systems more resilient to disaster, that improve the reliability of the electric grid and enhance cybersecurity.

So, we will continue to work constructively with DOE to maximize the opportunities, to maximize the programs that the Department of Energy manages on infrastructure, and we’ll do the same for the Department of Agriculture.

What’s the status of EPA’s regulatory rollbacks for the power sector?

Finkel: They’re all at different stages. EPA has begun the process of walking back all those regulations, notably the power plant rule. They’ve announced that they’re going to repeal many of these regulations finalized by the Biden administration, whether it is for greenhouse gases … or wastewater for power plants, coal residuals and a series of other air regulations that would make it cost-prohibitive to continue to run coal plants and make it really difficult to build new gas plants.

The EPA is working through their process to not only repeal them but make those repeals durable, which I think is really important.

Giving a greater degree of certainty to our asset owners is important as they continue to make decisions on generation investments and what their generation mix should look like.

Electric co-ops have sought to tap federal infrastructure funding through the New ERA program and some of the bipartisan infrastructure law initiatives. What’s the status of that funding?

Finkel: We continue to engage constructively with federal agencies about infrastructure investment programs and the value that they bring to the rural communities served by our members. Those investments have outsized impact on economic growth and stability, but also on the reliability and affordability of the power delivered in those communities.

As long as we continue to tell our story, it enables us to have a constructive conversation with administration officials.

Data centers and other large loads are a huge source of demand growth for the power sector, including electric co-ops. What’s happening on the policy front there?

Finkel: These are new, really large loads that are coming onto the system, and they’re important. They’re an important part of our day-to-day lives, in our electronic commerce, in our data-driven economy.

In order to meet this growing demand, you need a permitting process that moves quicker and faster. Today, it’s much faster to build a data center than it is to build a power plant.

If the load is moving faster than the generation, you obviously are going to be a little bit out of sync. Having federal policies that make it easier to build more generation faster, I think is really important.

What’s the regulatory outlook for broadband?

Finkel: There has been a fair amount of work by the Federal Communications Commission to reduce the regulatory burden on broadband providers, especially on small providers. And we greatly appreciate those steps that they’ve taken.

At the same time, the Broadband Equity, Access and Deployment program is the largest single investment in unserved broadband deployment in our nation’s history.

The challenge has been that the rules have continually changed. It makes it really difficult to make decisions on whether or not you want to participate when the rules are always changing. That’s really not the best model.

We’re hopeful that things can stabilize and these programs can execute with a clear set of rules and metrics where the bar doesn’t keep rising and the rules keep changing. We need to make sure this program works for co-ops and doesn’t favor other providers.

Erin Kelly and Molly Christian are staff writers for NRECA.