Electric cooperatives’ retail fuel mix nationwide is trending toward natural gas and renewable energy resources and away from coal-based generation as costs and regulations boost lower-emission energy sources, NRECA data shows.

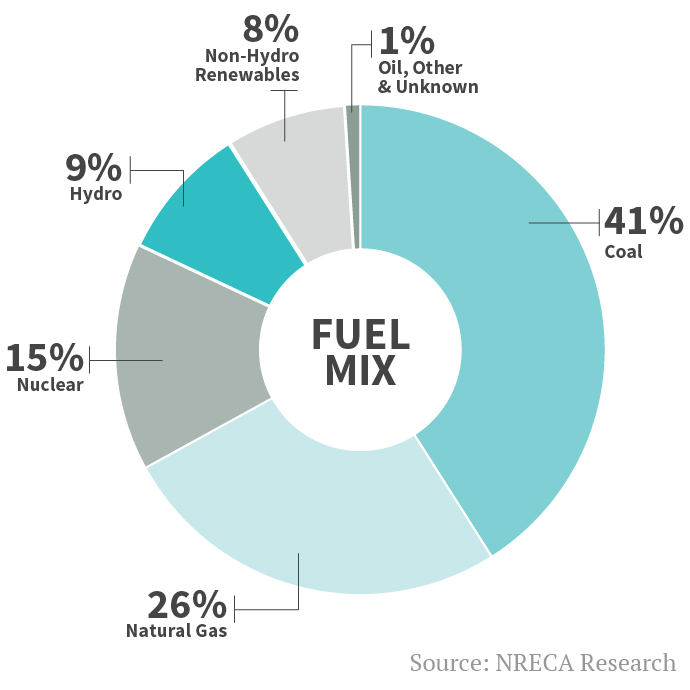

The share of co-op electricity coming from coal was at 41 percent in 2016 compared with 54 percent in 2014, according to recently released research from Lauren Khair, NRECA regional economic analyst, and Michael Leitman, NRECA strategic analyst.

“We attribute that reduction in coal as a fuel to the changes in the electric industry, specifically changes in market fundamentals, including low natural gas prices, lower renewable technology costs, and coal power plant retirements,” Khair said.

As coal use decreased, natural gas rose from 18 percent in 2014 to 26 percent in 2016. The share of renewable energy resources (non-hydro) doubled from 4 percent to 8 percent for the same period. Hydro and nuclear power remained about the same at 9 percent and 15 percent, respectively, according to Khair and Leitman’s research.

Back in 2009, coal accounted for 58 percent of the national retail electric fuel mix for co-ops while natural gas had a 12 percent slice and renewables only 3 percent, their research showed.

Powerful Sources

Khair and Leitman found the drop in coal use between 2009 and 2016 tracked low gas prices, growth in renewable energy and coal-based power plant retirements due to changing economics and environmental regulations, such as the Mercury and Air Toxics Standards that the Environmental Protection Agency issued in April 2016.

Electric co-ops own 26.6 gigawatts of coal capacity. Additionally, the Tennessee Valley Authority, an associate member of NRECA, owns 13.4 GW of coal-based generation and its co-op customers account for 10 percent of all co-op retail electricity sales nationwide.

“Renewable energy mandates in 29 states and federal subsidies have driven the growth of renewable resources nationwide and at cooperatives,” said Leitman. “Yet, sustained cheap gas, perhaps, is the biggest influence of the fuel mix.”

Khair and Leitman said natural gas prices are expected to remain steady through 2019 and cooperatives are in the process of adding new combined cycle capacity to their fleets. “So, in the near-term, natural gas’s share is likely to remain steady or increase,” Khair said.

Co-op-owned power plants generated 220 million megawatt hours of electricity in 2016, the latest year G&T data was available for the study by Khair and Leitman.